The e-commerce scene in Europe is highly diverse. New data from Eurostat and the EHI Retail Institute in Germany reveal significant differences between regions and challenges that affect the entire industry. For companies doing business across Europe, understanding these insights is crucial. Whether they're looking to enter new markets or improve their current operations, these findings can help shape their strategies.

Recent data from Eurostat and the EHI Retail Institute highlight two clear realities: digital adoption in North-Western Europe (including Ireland) and ongoing challenges with returns across the continent.

Here’s what the latest figures mean for businesses and logistics partners.

(Source: Eurostat 2024 – datasets isoc_r_blt12_i and isoc_ec_ib20)

(Source: Eurostat 2024 – datasets isoc_r_blt12_i and isoc_ec_ib20)Ireland Among Europe’s E-Commerce Leaders

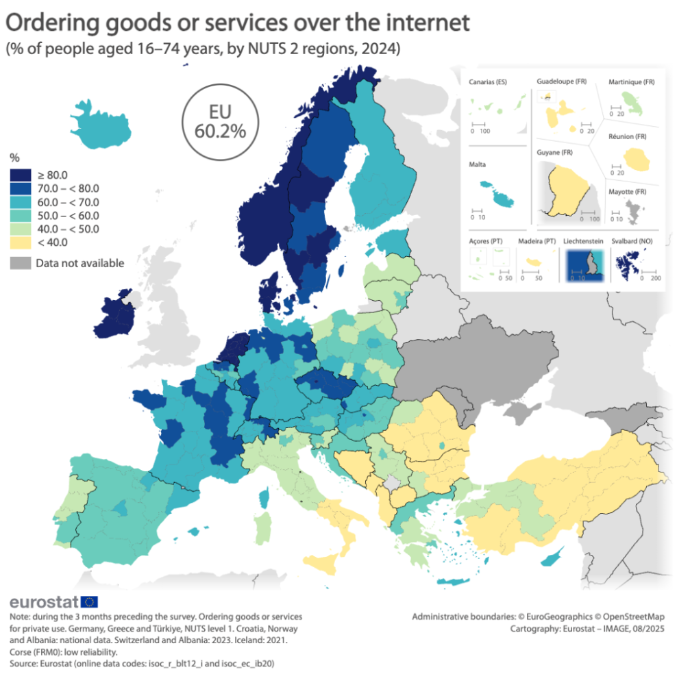

Eurostat’s 2024 regional data shows a striking north-west versus south-east divide in online shopping. While some regions lag behind, Ireland stands out as one of the continent’s digital frontrunners.

1. All three Irish regions record online shopping penetration above 80%.

2. The Northern and Western region ranks third in the entire EU, with 88.3% of 16–74-year-olds having bought online in the three months prior to the survey.

3. Ireland is one of only five countries or areas (alongside the Netherlands, Denmark, Sweden, and Prague) where every NUTS 2 region exceeds 80%.

By comparison, the EU average is 60.2%, and 21 regions – mainly in Romania, Bulgaria, and southern Italy – remain below 40%. The lowest rate is just 21.7% in Bulgaria’s Yugoiztochen region.

This strong domestic performance, combined with excellent connectivity to the UK and continental Europe, continues to make Ireland an attractive hub for e-commerce fulfilment and distribution.

The Persistent Challenge of Returns

High adoption brings higher volumes – and, inevitably, higher returns. A new study by Germany's EHI Retail Institute, based on 124 leading retailers in the DACH region, paints a sobering picture:

1. Almost 80% of retailers expect return rates to stay the same or worsen over the next three years.

2. Fashion remains the clear outlier: 87.7% of respondents report return rates of up to 50%, with 12.2% facing even higher levels.

3. Electronics, furniture, toys, books, and media enjoy far lower rates, typically below 10%.

Processing costs are equally concerning. More than half of retailers estimate €10 per return, 13.9% put the figure at up to €20, and over a quarter admit they cannot accurately calculate the true cost. For logistics providers, these figures underline the importance of efficient reverse-logistics networks, particularly for fashion clients.

AI and Automation: Opportunity Still Untapped

Despite the mounting pressure from rising return volumes and costs, the e-commerce sector’s adoption of artificial intelligence and automation remains surprisingly slow. The EHI Retail Institute’s research shows that many retailers are yet to capitalise on tools that could transform reverse logistics from a cost centre into a competitive advantage. In a market where Ireland and other North-Western countries are seeing ever-higher order volumes, the ability to predict which items are most likely to be returned – and why – can dramatically improve inventory planning, reduce processing times, and enhance customer satisfaction. Yet the data reveals a significant implementation gap that forward-thinking logistics partners can help their clients close.

1. Over a third (34.4%) of retailers still record return reasons manually, introducing errors and limiting the quality of data available for analysis.

2. Only 29.5% have fully automated return-reason capture and processing systems in place.

3. Although 45.5% of respondents acknowledge the value of AI for forecasting and reducing returns, 35% currently have no plans to invest in such solutions.

Early adopters who integrate AI-driven forecasting and automated processing are likely to gain a significant cost and service advantage in the coming years.

Three Practical Takeaways for Logistics and E-Commerce Players

1. Prioritise North-Western Europe, including Ireland, for mature, high-volume e-commerce demand; plan patient, education-focused strategies for emerging South-Eastern markets.

2. Build category-specific capability: robust reverse logistics for fashion, leaner processes for electronics and furniture.

3. Invest in data and automation sooner rather than later – the gap between leaders and laggards is widening.

Ireland’s strong digital adoption, strategic location, and advanced logistics infrastructure place us in an excellent position to support businesses navigating this varied European landscape. If you’re reviewing your 2025 e-commerce supply chain strategy, we’d be happy to discuss how we can help.